All practices

Customs Law and Foreign Economic Activity

About practice

The VERBA LEGAL team provides comprehensive legal support on matters of customs regulation and foreign economic activity. The practice lawyers have extensive experience in conducting legal audits of foreign trade operations, structuring supply chains in compliance with customs and tax legislation, as well as advising on product classification and customs valuation.

The customs law team supports clients at all stages of customs control and successfully represents their interests in disputes with customs authorities at both the pre-trial and judicial stages.

The practice’s clients include leading Russian and international pharmaceutical companies, medical device manufacturers, major multinational FMCG corporations, retail companies, automotive distributors, cosmetic brands, as well as other organisations engaged in foreign economic activity across various industries.

The customs law team supports clients at all stages of customs control and successfully represents their interests in disputes with customs authorities at both the pre-trial and judicial stages.

The practice’s clients include leading Russian and international pharmaceutical companies, medical device manufacturers, major multinational FMCG corporations, retail companies, automotive distributors, cosmetic brands, as well as other organisations engaged in foreign economic activity across various industries.

Services

1/

1/

Advice on all aspects of customs regulation, including customs valuation and the need to include royalties, dividends and intermediary commissions

2/

Legal review of goods classification in accordance with the EAEU Commodity Nomenclature of Foreign Economic Activity (CN FEA)

3/

Legal support during customs control procedures and at the stages of pre-trial and judicial appeals

4/

Structuring and optimisation of internal foreign economic activity processes

5/

Assessment of compliance with customs legislation and customs due diligence

6/

Advice on structuring foreign economic transactions, including through intermediaries and third countries

7/

Preparation of legal opinions on changes in customs legislation and their impact on business; support in the legislative process

8/

Legal assessment of compliance with prohibitions and restrictions, as well as conditions for applying benefits and preferences

9/

Obtaining permits and authorisations for the import and export of goods

10/

Representation of foreign economic activity participants before the EAEU Court

11/

Defence of clients’ interests in the course of operational-search activities and within administrative and criminal proceedings

Selected Experince

we advised:

a Russian pharmaceutical company on the assignment and amendment of the EAEU CN FEA code for an active pharmaceutical ingredient (API) upon import into the Russian Federation, including assessment of risks of additional customs duties and development of a risk mitigation strategy;

a Russian participant in international shipping on the application of a 0% VAT rate and a zero import customs duty rate in connection with the import of sea vessels;

a number of Russian pharmaceutical companies on the classification of cosmetic and dental medical devices under the EAEU CN FEA, including assessment of reclassification risks by customs authorities and preparation of recommendations to mitigate such risks;

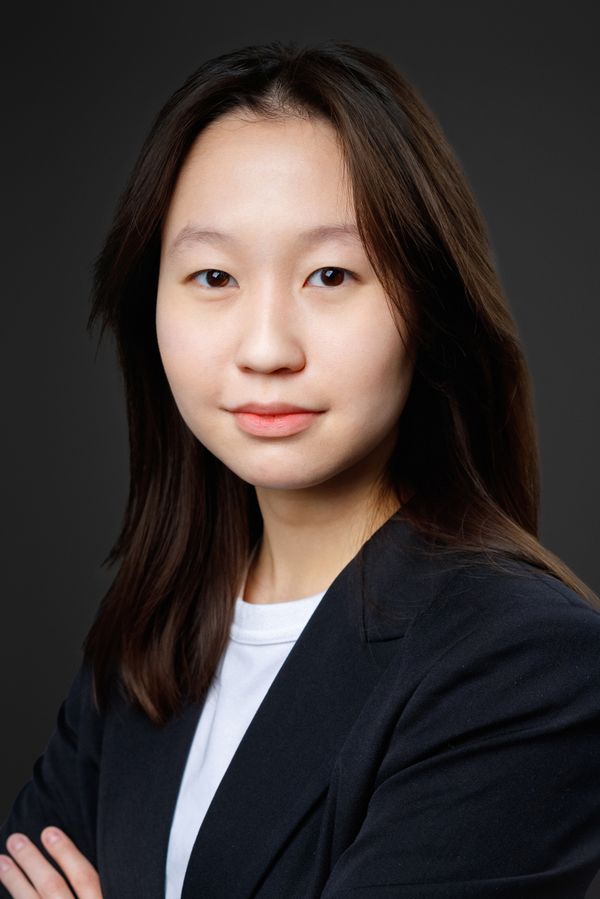

Who will be working with you

Our team